Grades 6-8

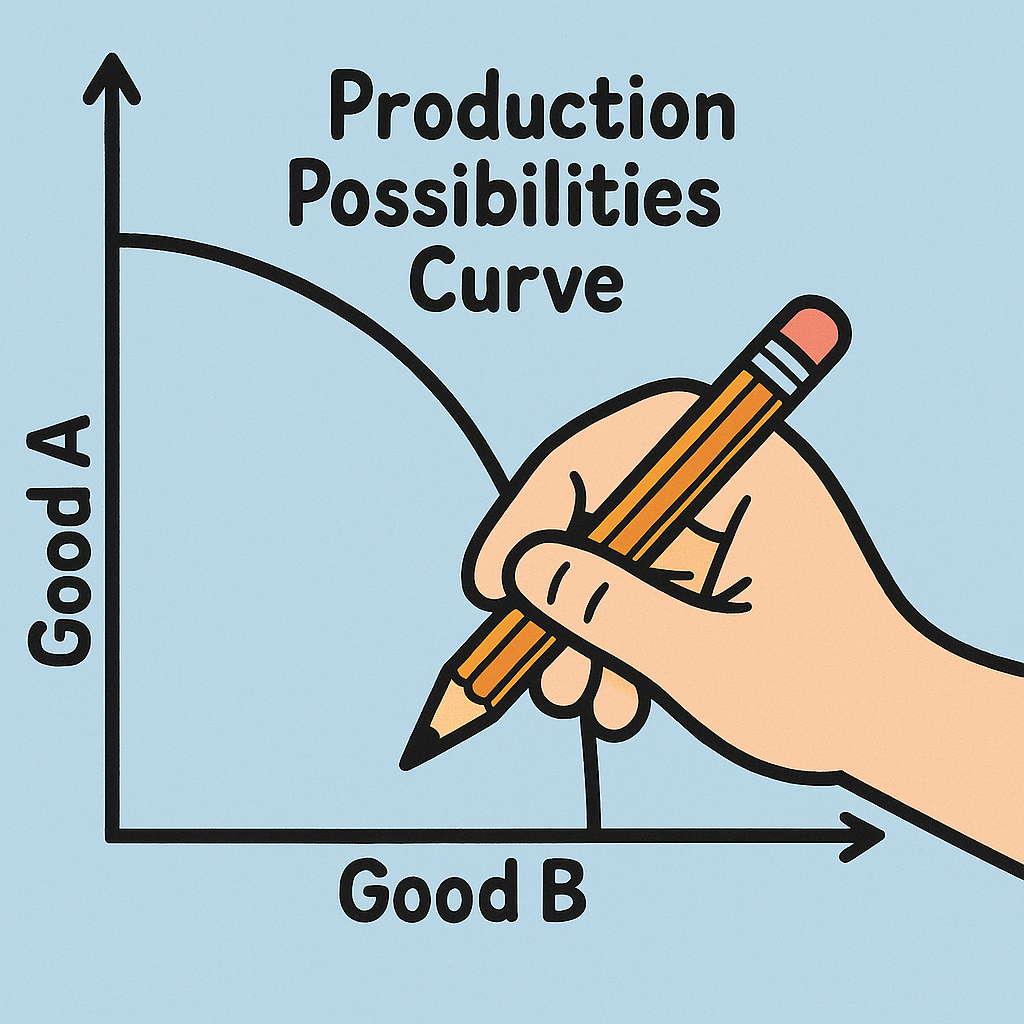

Mario's Choice - Decision Making and Opportunity Cost

In this middle school lesson, students use decision-making skills to solve a scarcity problem and then write their own stories...

Key Concepts: Basic Economic Concepts, Buying Goods and Services, Decision Making…